The Federal Government reinstates the federal tax credit 25C program, extending the credit program to December 31, 2020.

Insulation Tax Credit 2020

Homeowners across the USA can now enjoy discounts for insulation upgrades (excludes cost of labor) in their principal residences through the end of 2020.

Tax Credit Sections

Is There A Tax Credit For Adding Insulation?

Yes, this is the final year the Tax Credit is running in the USA. The Tax Credit stops after December 31, 2020.

Section 25C: Tax Credit For Qualified Energy Efficiency Improvements

This legislation offers a 10% tax credit worth up to $500(Lifetime Cap) for homeowners, qualified energy-efficient upgrades such as building insulation.

Section 45L: Credit For Energy Efficient New Homes

Provides a $2,000 tax credit to homebuilders for the construction of homes exceeding heating and cooling energy standards by 50%. The base energy code is the 2006 International Energy Conservation Code plus supplements.

Section 179D: Energy Efficient Commercial Buildings Deduction

Provides a deduction up to $1.80 per square foot for commercial and multifamily property that exeed specific energy efficiency requirements under ASHRAE 2007.

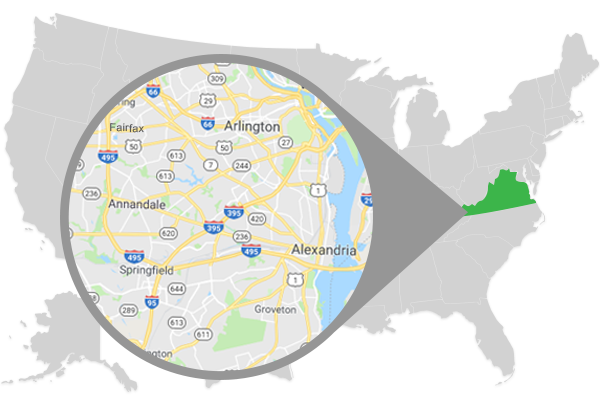

Contact Summit Environmental Solutions for Home Insulation in Fairfax, Alexandria & Arlington, VA.

Insulating your home has proven to provide the largest and quickest results for energy savings and comfort. Contact us today at 703-520-5868 for Insulation Services in Virginia.